Find valuable financial crisis books to understand the crypto market crash!

There are no doubts about it – whether it comes to Bitcoin or other cryptocurrencies, they are all volatile. They have an incredible track record of boom and bust. Some digital coins have not managed to recover, but some of them stands out – Bitcoin & Ethereum. It goes up and down on a regular basis, and the jumps are spectacular. Most people ask themselves today – is a Crypto market crash inevitable?

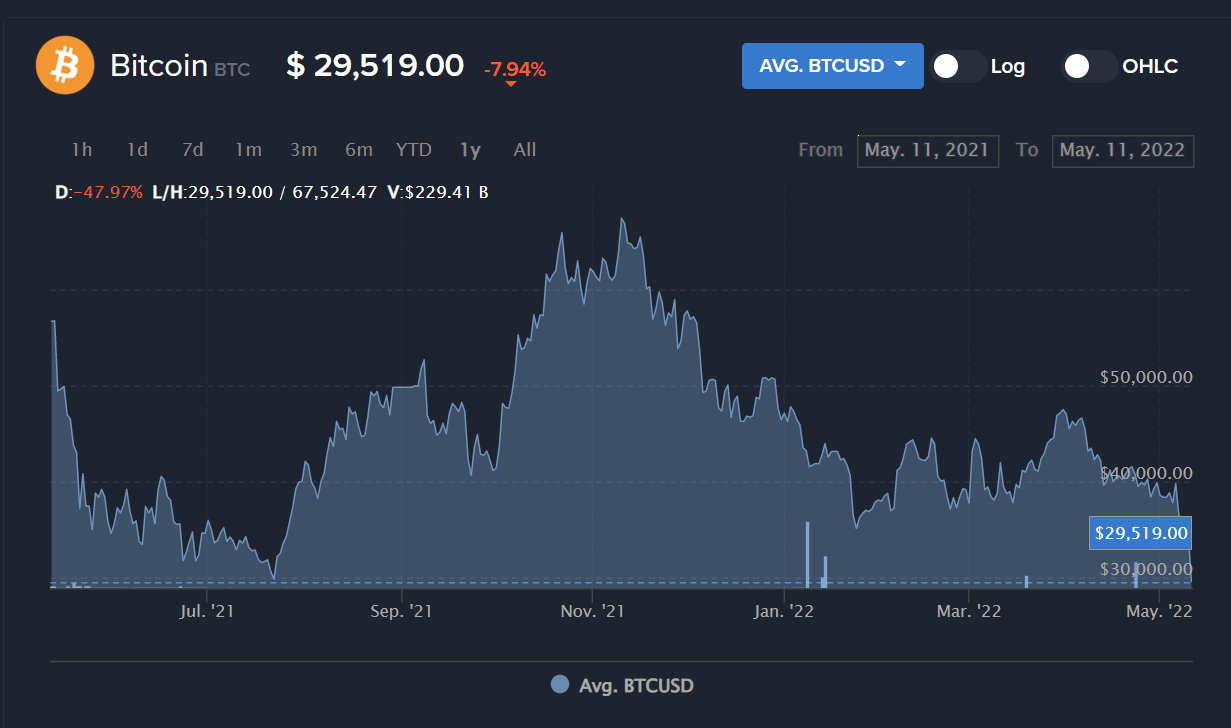

2021 was like a roller coaster ride for Bitcoin. Basically, the coin has managed to hit its all-time record – just under $70,000 in the fall of 2021. But then, 2022 brought in a falling trajectory. By May of 2022, Bitcoin was valued at about $30,000. The case was similar to Ethereum. Whether you want to understand more about this industry, here are some financial crisis books that will help.

Why Is Crypto Market Crashing?

So, why is crypto market crashing? The truth is all markets crash, but not as often as this one. There are all sorts of financial crises hitting every now and then – usually with decades between one and another. Digital coins are so volatile that they could never follow the same trends. Such crashes occur more often, and the impact is devastating – some people go rich overnight, while others lose their savings.

The Bitcoin price has lost about 40% in less than two months. The bad news is that Bitcoin seems to influence the whole market. Practically, other popular digital coins have also been dragged down and lost similar amounts of value – whether you think about Ethereum, BNB, Cardano, or XRP. Most digital coins out there lost value.

Believe it or not, the cryptocurrency market has declined from $3 trillion to $2 trillion in a few months only. The crash is quite substantial if you look at numbers, and it occurred after a consistent period of growth. Keep in mind that the cryptocurrency market was worth about $200 billion a few years ago. Some believe this is a temporary setback, but most critics associate it with the beginning of a crisis.

Now, the big question – why is the crypto market crashing? Just like for any other market, there are certain indicators that can push people in one direction or another. For instance, the hiking interest rates in the USA could be a pretty good reason. China’s consistent crackdown on digital coins has also contributed. Plus, there are rumors about Russia being interested in banning cryptocurrencies as well.

Not sure if this is the right time to invest? Should you wait some more maybe? Hard to tell. But one thing is for sure – the more you know about the crypto market crash and the more financial crisis books you read, the easier it becomes to make an informed decision. This market is for those who are willing to risk, as well as those who educate themselves round the clock.

What Are The Best Books That Explain The Crypto Market Crash?

The Ecstatic Stock Market, by David Rasmussen

David Rasmussen has put more than three decades of experience in the stock market in this book. This book promotes a completely different aspect that most people have never even imagined. It explains why the market is irrational, but also why it acts in such an ecstatic manner – and not just the digital coin one.

The real estate crisis from 2007, the current Bitcoin bubble… These are only some small crises residing into a bigger one. A giant bubble is about to unfold, and no one will be able to predict its future. All in all, this financial crisis book is a must-read if you are interested in the current situation.

Crashed, by Adam Tooze

This book comes from an economic historian with a good record in predicting future changes and crises. It takes you back to the crisis from 2007 for a bit. The global event affected everyone, everywhere. No one could get out of it, but the world somehow managed to recover. What has changed since then?

The book analyzes how the world has changed in 2007, as well as the decade that followed up. It aims to help you identify patterns, as well as the realistic end to a financial crisis – not just what the media tells you. The book is suitable to analyze a potential crypto market crash in the future as well.

The Big Short, by Michael Lewis

The real financial crisis from 2007 began randomly. It did not hit major players on the market or big economies. Instead, it started in some markets that no one really knows about. It began in markets that the SEC does not even bother about. It started in markets that were prone to failure anyway.

On the other hand, those who understand what was going on were paralyzed. There was a lot of fear, as well as a bit of hope. No one dared to say anything. Tue author comes up with a fresh approach on the crisis and tackles the outcome in a smart, but also humorous manner.

If you want to understand the crypto market crash you need first understand the past.

All the Devils Are Here, by Bethany McLean and Joe Nocera

This is probably one of the most shocking financial crisis books out there. It does not analyze the actual crisis. It does not mention who is guilty for everything. It does not make a difference between the Wall Street, sleazy companies, legislators or traders. Instead, the answer is further up.

The book goes back a few decades and analyzes some trends that defined the financial crisis from 2008. Basically, it explores motivations, famous CEOs, secretaries and politicians. It delves into the concept of home ownership and shows that the crisis was about human nature and not about money.

Too Big to Fall, by Andrew Ross Sorkin

The author reveals how the most significant financial crisis since the Great Depression unfolded. Everything is explained in small details, step by step. It was a tiny issue that evolved into a global tsunami. Get ready to explore secrets, meetings and plans from Washington, South Korea and so on.

The book takes everything to another level. You gain access to the key players of this crisis – something that no other author has done before. Many details were misunderstood back then, but they are crystal clear today. It is not just a true story and a real-life thriller, but an educational book for enthusiasts as well.

Stress Test, by Timothy Geithner

This book may reveal some hints about a potential crypto market crash while analyzing previous crises and the factors behind them. The author is one of the key players of the 2007 crisis and helped the country navigate through it and recover in no time. This is not a story, but an actual memoir.

Timothy Geithner explains the choices he had to make, the political decisions that fixed the system and the elements that pushed the economy to the edge of collapse. While the book covers the last major crisis, you will notice multiple comparisons to previous crises and how some decisions are better.

After the Music Stopped, by Alan Blinder

You do not have to be an economist or an expert to understand this book. Known as one of the most transparent financial crisis books, After the Music Stopped takes you through the growth and flaws of the financial system in the USA – the system that led to a severe crisis of the real estate industry in 2007.

The crisis expanded to other sectors as well before being finally cleared out with huge sacrifices. The book analyzes the system, which became too complex for its necessity, but also too unregulated for the public. The book also explains how international decisions prevented the world from reaching a meltdown.

The Greatest Trade Ever, by Gregory Zuckerman

This book analyzes how hedge fund manager John Paulson made a bet and won. He placed this bet despite everything that was obvious to all managers and financial advisors out there. He somehow knew that the housing market will fall soon enough. Along with a bunch of other investors, he bet on failure.

This book analyzes the moves that convinced John Paulson to go in this direction and make a fortune out of a financial crisis. It analyzes the concepts and signs that indicated a potential crisis way before it actually happened – some ideas that every investor could learn from, regardless of the industry.

Conclusion – Why Crypto Market Crash Happening?

Bottom line, some of these financial crisis books define the trends that underline such a crisis. Some others analyze what happened during the crisis from 2008. No matter what you invest in – be it cryptocurrencies, real estate or something else, all crises have something in common. At some point, the market is likely to get overinflated and that is when things go wrong.

Education is essential in this field. Knowing how to assess trends and identify different concepts is critical. There are signs that can indicate a crisis – some of them years before it actually happens. Some others pop up when the situation can no longer be avoided. Learn from others’ mistakes and figure out a plan before the inevitable actually occurs.

If you want to learn more about cryptos, read our selection of blockchain technology books, the best NFT books or how the cryptos will be connecting to gaming.